source: editor:Zhang Wenni

To effectively enhance the convenience of customs clearance for personal postal items and further optimize customs government services and administrative efficiency, the General Administration of Customs of the People's Republic of China launched the "one-stop" service platform for inward and outward personal postal items on July 1.

Whether your inward parcels require a supplementary declaration, duty payment, duty reassessment, duty refund, return shipment request, or status inquiry, you can easily process them yourself on this platform.

Access to the Platform

Web Access

"Internet + Customs" Platform

https://online.customs.gov.cn/

China International Trade Single Window

https://www.singlewindow.cn/

Mobile (App) Access

"掌上海关" APP or "掌上海关" WeChat Mini Program

WeChat Mini Program

Eight Core Functions

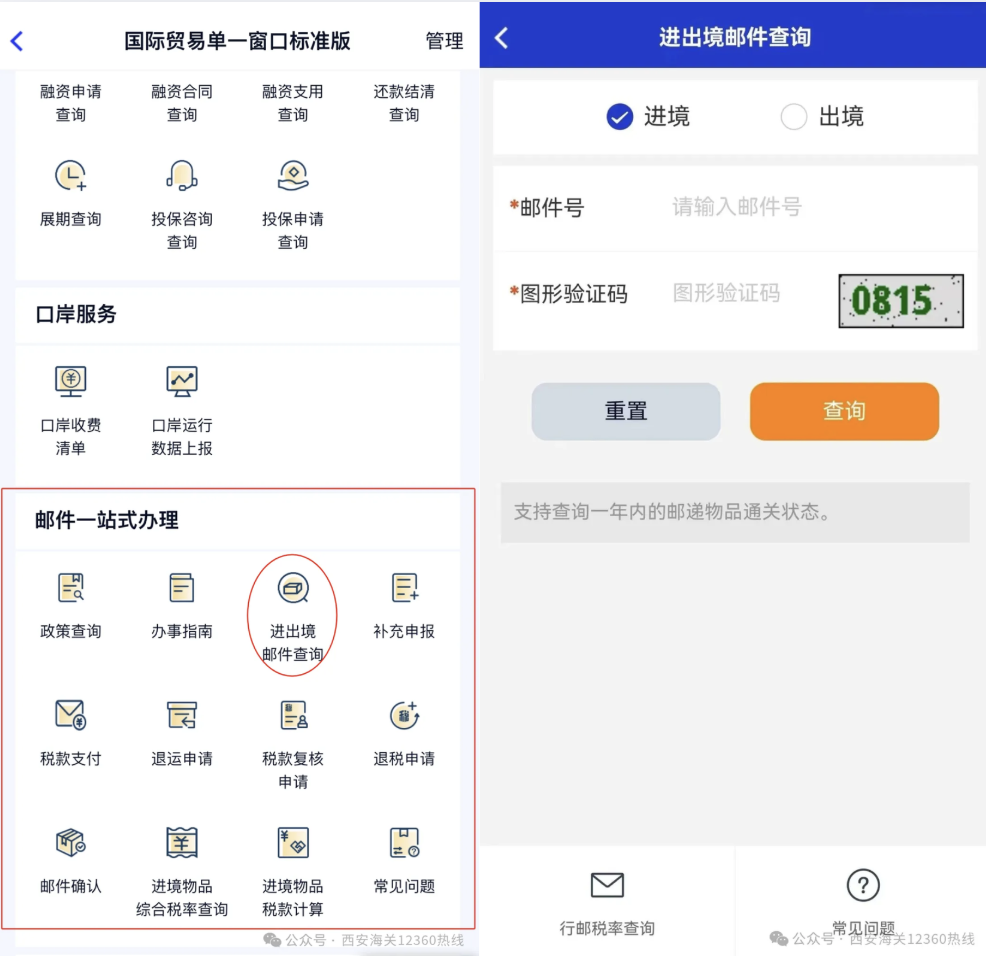

Inward/Outward Postal Items Inquiry: After entering the "one-stop" service platform, click "Inward/Outward Potal Items Inquiry", select the parcel type (inward or outward), enter the parcel tracking number and verification code to check the clearance status. This function supports inquiries for parcel clearance status within the past year.

Supplementary Declaration Inquiry: Click "Supplementary Declaration" to enter the page, then click the "Inquiry" button on the right to view information on parcels bound to your registered mobile number that have undergone supplementary declaration, along with customs receipts.

Payment Record Inquiry: Click "Duty Payment" to enter the service interface, then click "Payment Record Inquiry" to access the payment inquiry screen. You will see a list of taxed parcels bound to your registered mobile number and customs receipts in the interactive box.

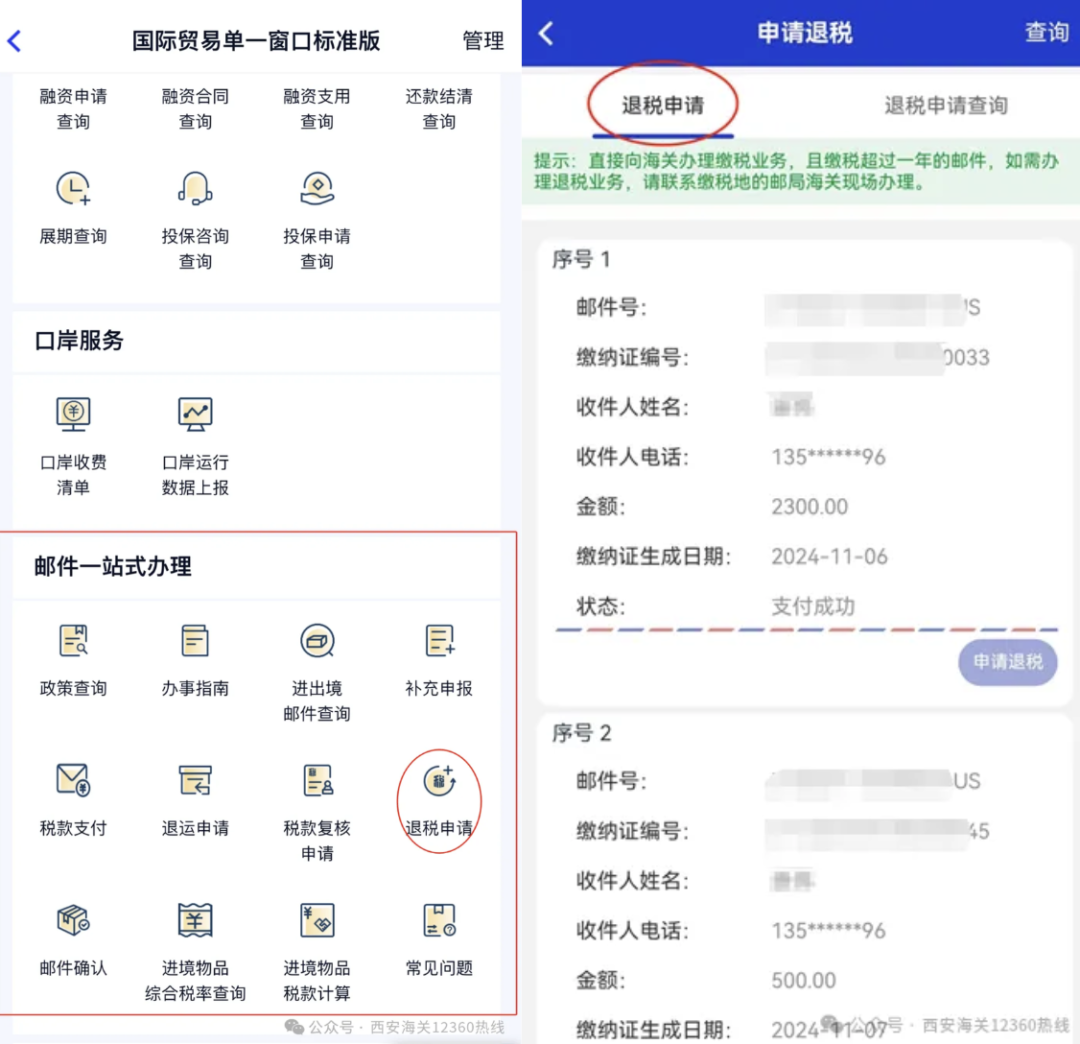

Duty Refund Application: Click "Duty Refund Application" to enter the service interface. You will see a list of taxed parcels bound to your registered mobile number. Select a specific parcel item, click "Apply for Refund" to enter its refund application interface. Fill in the required information to initiate the refund application for that parcel.

Refund Application Inquiry: Click "Duty Refund Application" to enter the service interface, then click "Refund Application Inquiry". You will see a list of parcels bound to your registered mobile number for which refund applications have been initiated, along with customs receipts, in the interactive box.

Duty Reassessment Application: Click "Duty Reassessment Application" to enter the service interface, then click the "Apply" button on the left. You will see parcels bound to your registered mobile number eligible for the duty reassessment application in the interactive box. Select a specific parcel to initiate the reassessment application.

Return Shipment Request: For parcels with a status of "Pending Supplementary Declaration", "Referred for Cargo Declaration", or "Pending Duty Payment", you can apply for return shipment if you do not wish to proceed with clearance. Click "Return Shipment Request" to enter the service interface, then click the "Apply" button. You will see a list of eligible parcels bound to your registered mobile number. Select a specific parcel and click "Request Return Shipment" to initiate the application.

Inward Items Comprehensive Tax Rate Inquiry: Enter the item name to quickly query its corresponding classification number and applicable tax rate.

Calculation of Tax on Inward Items: Estimate the amount of tax that needs to be paid according to the selected items.

Key Policy Points

1. According to relevant provisions in Chapter IV "Inward and Outward Articles" of the Customs Law of the People's Republic of China:

Article 46: Inward and outward luggage carried by travelers and inward and outward postal items shall be limited to reasonable quantities for personal use and subject to Customs control.

Article 47: All inward and outward articles shall be accurately declared to the Customs by the owner and subject to Customs examination.

2. General Administration of Customs Announcement P.R. China No.43 of 2010 and General Administration of Customs Announcement P.R. China No.176 of 2024:

For articles mailed into China by individuals, Customs shall levy import duties according to law. Import duties amounting to RMB 50 or less are exempted.

Items mailed from overseas to China have a limit of RMB 2,000 per shipment. Items mailed by individuals to Hong Kong, Macao, or Taiwan were limited to RMB 800 per shipment; items to other countries and regions are capped at RMB 1,000 per shipment.

Where the value limit is exceeded, the items shall be returned or cleared according to the procedures for goods. Where there is only one indivisible item exceeding the value limit, it may be cleared as personal articles upon Customs verification that the item is indeed for personal use.